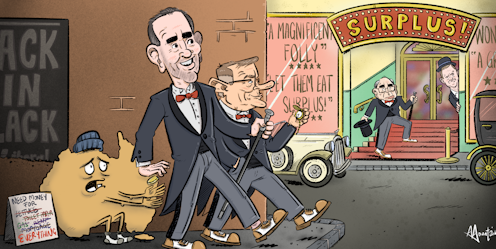

Economists award Chalmers top marks for budget, but less for fighting inflation

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Wes Mountain/The Conversation, CC BY-ND

Wes Mountain/The Conversation, CC BY-NDAsked to grade Jim Chalmers’ second budget on his own criteria of delivering “relief, repair and restraint”, most of the 57 leading economists surveyed by the Economic Society of Australia and The Conversation give it top marks.

On a grading scale of A to F, 37 of the 57 economists –...

Read more: Economists award Chalmers top marks for budget, but less for fighting inflation