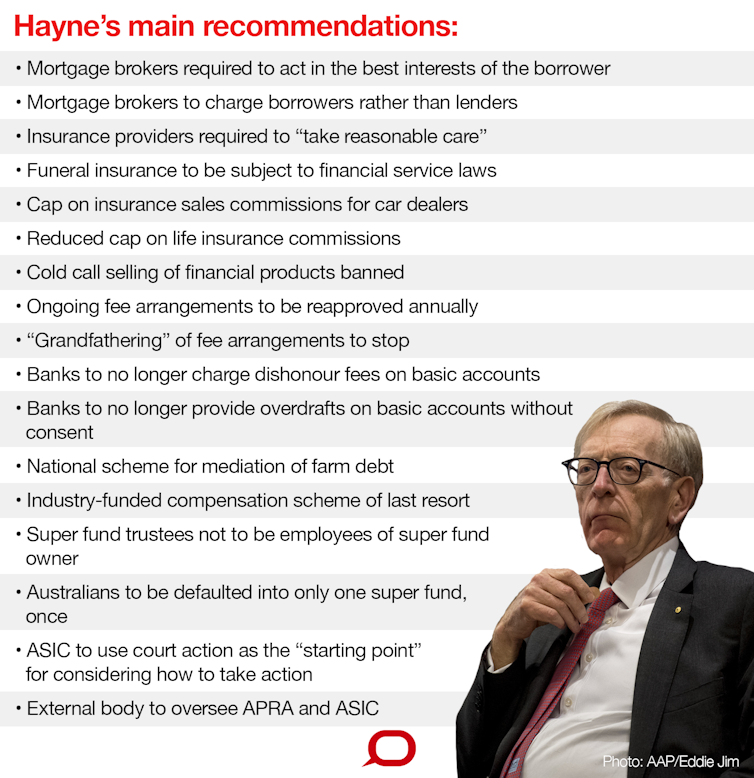

Compensation scheme to follow Hayne’s indictment of financial sector

- Written by Michelle Grattan, Professorial Fellow, University of Canberra

The Morrison government has promised to establish a compensation scheme of last resort - paid for by the financial services industry - as it seeks to avoid the outcome of the banking royal commission becoming a damaging election issue for it.

Treasurer Josh Frydenberg, releasing Commissioner Kenneth Hayne’s three-volume report which...

Read more: Compensation scheme to follow Hayne’s indictment of financial sector